Taiyo Kogyo Column

Key SME Tax Incentives: Effective Use of Tent Warehouse Construction

2025.03.17

The Small and Medium Business Management Reinforcement Tax Credit allows small and medium-sized enterprises (SMEs) that make capital investments to deduct the cost of such investments from their corporate and income taxes if they meet certain conditions.

The deadline for certification has been extended to March 31, 2025, and if the conditions are met, this preferential tax treatment can be used for the construction of tent warehouses.

Under this system, small and medium-sized enterprises (corporations with capital of 100 million yen or less or individuals with 1,000 or fewer regular employees) that file a blue tax return can receive a tax credit (7% or 10% credit) or immediate depreciation when they install qualifying equipment. The tax credit is either a 7% or 10% deduction, or an immediate write-off.

The program is also positioned to support the promotion of work style reforms, and capital investments to improve the workplace environment and business efficiency are also eligible.

Eligible businesses range from manufacturing, construction, agriculture, retail, and food service, and also include road freight transportation and warehousing businesses that require warehouse facilities.

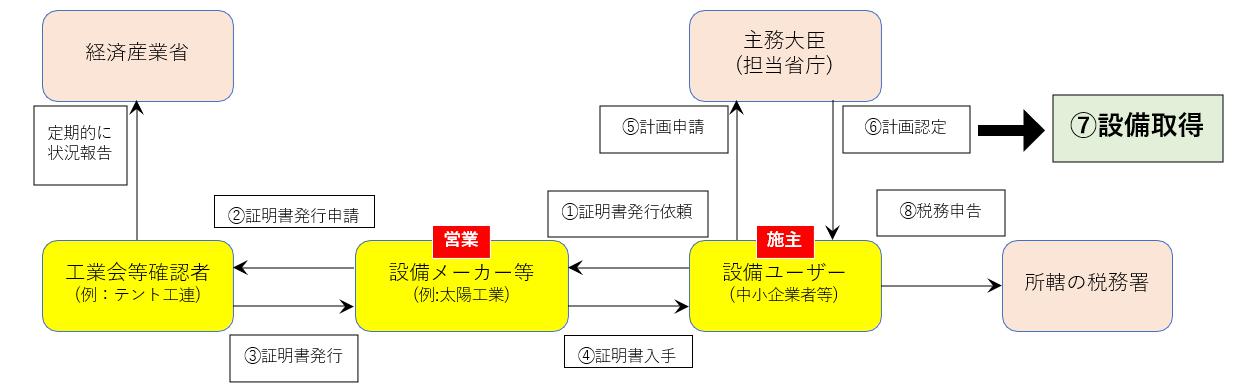

Toward certification

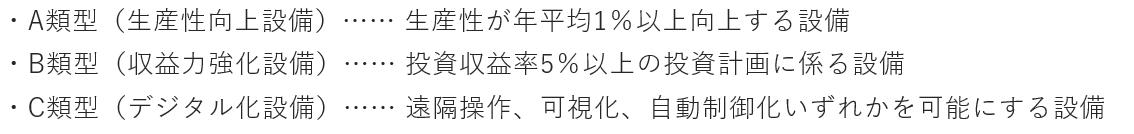

There are three types of plans, from Type A to Type C. The first is to formulate a business improvement plan in cooperation with a tax advisor, etc.

For example, the following cases fall under Types A and B.

Problem: The company rents a warehouse externally, which increases costs due to skyrocketing rents. In addition, the company has little flexibility in transporting goods to and from bases scattered around the country, and is struggling with rising fuel costs and securing driver factors. (2024 Issue)

Solution: Lower fuel costs and reduced labor hours by building a new warehouse and consolidating to one relay point. Also, by locating onsite, productivity was increased, and even with more appropriate personnel, efficiency was improved, resulting in higher revenues.

Such cases are common in the transportation industry. By taking advantage of the tax benefits for small and medium-sized enterprises (SMEs), you can improve operational efficiency, reduce costs, and ultimately increase profits. We recommend that you check whether your company is eligible for this program and make the most of it.

Capital – 100 million or less – 30 million or more → 7%.

Less than 30 million → 10%.

(Advantage) Immediate depreciation: eligible equipment costs can be expensed in a lump sum in the same year

*Designation expires “by March 31, 2025.”

Not “application deadline” but “deadline for certification” ←It may take 1 or 2 months to apply.

Applying for SME tax incentives requires specialized knowledge and experience.

It is important to check with your tax advisor to ensure the accuracy of the documents to be submitted and to confirm the requirements.

Details of tax measures

Immediate depreciation (100% of purchase price can be expensed) or tax deduction (up to 10% of acquisition price)

Price requirements for investments to which tent warehouses are applicable

Buildings and accompanying facilities of 600,000 yen or more

Eligible Companies

Conditions apply, such as corporations with capital or investments of 100 million yen or less.

Certification deadline

March 31, 2025

Applicable equipment

The facility meets the following two conditions

- Models sold within a certain period of time

- Facilities whose indicators (production efficiency, energy efficiency, systems, etc.) that contribute to the improvement of management capability have improved by an annual average of 1% or more compared to the previous model.

The use of “white” or “ivory” membrane material colors for the tent warehouses manufactured and sold by Taiyo Kogyo eliminates the need for lighting during the daytime and even in the rain, thus reducing costs due to the recent rise in electricity costs and improving energy efficiency. The tented warehouses in the table below are considered to be eligible for this project. Tent warehouses listed in the table below may be eligible for this project.

Application Process

Tent Warehouseへの

Contact us

What you need to know when building a warehouse

We packed it all in.

Clues to solving the 2024 problem

I want to build a warehouse in an economical way.

Which type of warehouse should we build?

I want to learn the basics of warehouse construction anyway.

I'm concerned about the 2024 problem, but I don't know what to do about it.

Related Articles

- TOP>

- Taiyo Kogyo Column>

- Key SME Tax Incentives: Effective Use of Tent Warehouse Construction